MARKET TREND HAS CHANGED.

WHAT DOES THAT MEAN FOR THE SUNSHINE COAST?

What does this mean for the Sunshine Coast?

Buyers should be cautious to believe the corrections will be long and steep. Covid permanently changed the way the economy works. In the past, local jobs drove the level of affordability on the Sunshine Coast, now we have a highly mobile work force that can work successfully from anywhere and the Sunshine Coast has become a highly desirable location.

Once interest rates stabilize (and begin to decline next year), we will see continued attention from the “work at home” sector which will mean demand in our area. We also have a notable number of buyers that were discouraged during the peak of the real estate mania. They will return in numbers as the economy settles back down.

Sellers may grumble a little over declining values. However, it remains a historically good time to sell, and a good time to pull the trigger on a move. You can re-situate yourself in another market for a price that is reflective of the general trend; Lower prices and increased value. This is a level of sanity that we have not experienced recently and should be welcome to most everyone.

Both buyers and sellers will be wise to note that the current situation is not a reflection of lowered “interest” in real estate, but rather a top-driven policy correction that has adjusted affordability across the board. Buyers should enjoy the moment and process compared to the past few years of craziness.

What’s Trending?

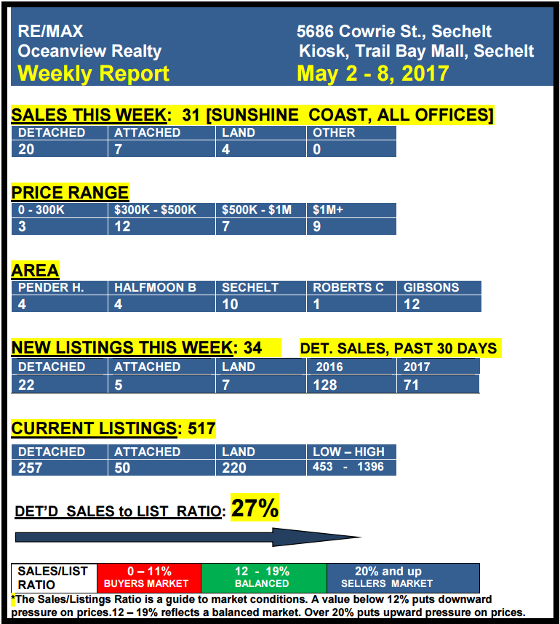

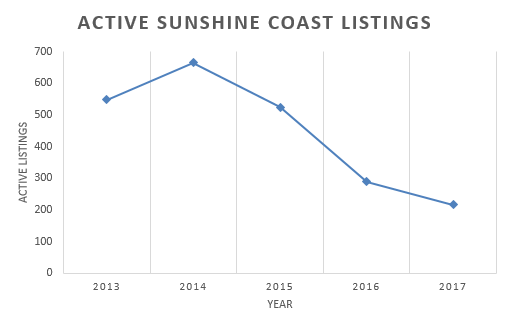

Over the past couple of weeks for the entire lower Sunshine Coast, we are seeing a noticeable trend to more affordable homes around and under a million dollars. This is likely going to continue to be the trend for the coming months with entry level homes becoming more affordable and improved value at the million dollar mark. Gibsons remains at a much higher price point than Pender Harbour with very different lifestyles associated. Sechelt is somewhere in the middle with values that are still notably lower cost than Gibsons, although both markets are showing increased inventory in the range.

|

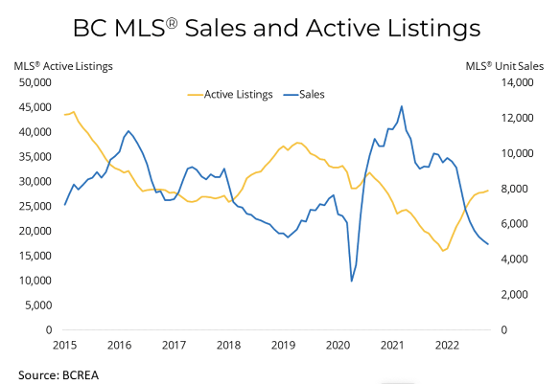

As you may have noticed by the graphs in "What’s Trending", the market prices remain near all-time highs. In the face of the increased interest rates that have occurred and are going to continue, it is probable that values will decrease. Sellers will always be as resilient as the market allows so we have seen a hard drop of 10% and it looks like we might expect a similar drop by this time next year. In other words, it is still a great time to sell and achieve a strong return on your real estate dollar. Sure... expectations have to be lower than the recent frothy 2022 but for anyone that is serious about making a change or liquidating a property, you may not see a better opportunity for a few years.

Getting Ahead of the Curve

When you are pricing your property for sale, experience has shown that you want to price “ahead of the curve”. In most markets, it takes a week or two for a property to gain market awareness. In that two-three week period, the market will not stay still and will either be going up, staying the same, or going down. The market moves forward so if your price is set at “today’s value”, then to be ahead of the curve you would need it to be a balanced market. In a declining market, values will actually be lower in two weeks so to get the best opportunity for a quick sale, you need to price that decline into your thinking. Sure it hurts a little, but it hurts a lot more if you try high and then tip toe down along with the market.

Most buyers should be relieved to find the market settling down, even if the cost of borrowing has increased. Given the shock to the real estate market of the interest rate hikes, we continue to experience slow downs across the board and with price reductions.