Buyer’s Market vs a Seller’s Market

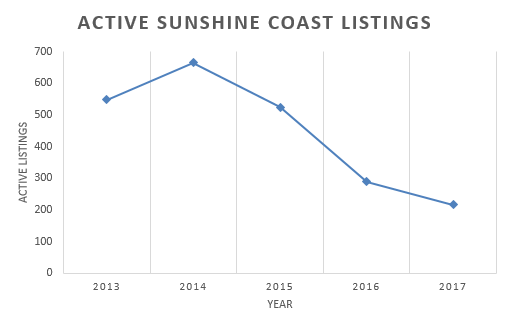

The story going into the 2017 Spring Market is easily the listing count. Despite hearing reports of markets correcting or facing headwinds, the listing count tells the tale. And it is amazing how much difference 5 years can make. While we saw a peak number of listings in 2014, the inventory had crept up after the financial meltdown in 2008 and a distinct lack of buyers meant that sellers were piling up against buyers and the market bounced around a sales-to-listing ratio (SLR) of 4-7% for a few years. This resulted in 2016 numbers reflecting a perfect storm of demand meeting supply. We saw historic volumes that we should can’t expect to see for another generation.

For those that don’t know, under 15% SLR is considered a “Buyer’s Market” which means fewer buyers than sellers and price pressure going down. 15-22% is considered a “Balanced Market” which means price stability and demand being met with supply and above 22% it is considered a “Seller’s Market” and there is pressure on prices to rise. This past week’s SLR was 23%. As we move into our first real period of decent weather in months with a listing count at the lowest level in 20 years, the picture remains clear – unless there is a major economic event, we will see a very buoyant market in 2017.

Buyers will be under pressure to make quick decisions but I think they will be rewarded. Sellers will continue to be of the mind to make a bit more money. As a caveat, the SLR is down from a high of 35% last year, and 23% isn’t a robust Seller’s Market. Thus, caution on price expectations is in order, but it is fair to remain optimistic that values are going to see a notable bump sooner than later. The upshot is that if you are thinking of taking advantage of the market now is the time to act. Send me an email if you want to have a chat on how the market is affecting your plans.

Talk to you next week!

Cheers,

Gord