MARKET TREND HAS CHANGED.

WHAT DOES THAT MEAN FOR THE SUNSHINE COAST?

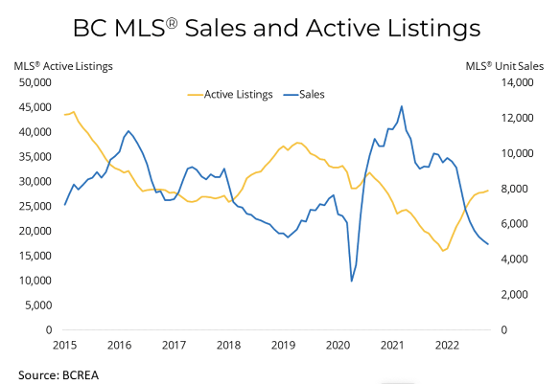

By now, we are all aware of or experiencing the Bank of Canada's attack on inflation by increasing interest rates, and consequently, brought real estate to a sudden and lurching lull. What that means for sellers, is that after an extended period of enjoying instant demand from an abundance of buyers and substantial price increases, a degree of that gain will be given back in what is now a Buyer's market. With fewer active buyers and an increasing amount of inventory, there is opportunity to create more value and time to be choosy. With these benefits, a buyer has the ability to negotiate better deals that can potentially be fruitful.

Affordability across the board in Canada has been affected despite what is still a low historic inventory level. Sales will fall, and inventory will rise. Lowered sales and increasing inventory are “leading” indicators, and it is inevitable that “trailing” indicators; which are "prices and values" will decline. Quite surprisingly, we have not seen as much decline in "asking prices" from the highs, which may be partly why sales remain on the lower side.

What does this mean for the Sunshine Coast?

Everywhere in the country sellers are realigning their expectations and we are seeing notable price drops across the board. This is great news for buyers who as recently (as a few months ago) had no time to make a calculated decision, let alone find a property that was better suited.

Buyers should be cautious to believe the corrections will be long and steep. Covid permanently changed the way the economy works. In the past, local jobs drove the level of affordability on the Sunshine Coast, now we have a highly mobile work force that can work successfully from anywhere and the Sunshine Coast has become a highly desirable location.

Once interest rates stabilize (and begin to decline next year), we will see continued attention from the “work at home” sector which will mean demand in our area. We also have a notable number of buyers that were discouraged during the peak of the real estate mania. They will return in numbers as the economy settles back down.

Baby Boomers who had been postponing their retirement had Covid reset their priorities. These people are aging closer to that reality, and the Sunshine Coast has always been an attractive landing spot for Lower Mainlanders. The bottom line is that there are many factors driving the local economy now that didn’t exist 10 years ago. These actors are not going away.

Sellers may grumble a little over declining values. However, it remains a historically good time to sell, and a good time to pull the trigger on a move. You can re-situate yourself in another market for a price that is reflective of the general trend; Lower prices and increased value. This is a level of sanity that we have not experienced recently and should be welcome to most everyone.

Both buyers and sellers will be wise to note that the current situation is not a reflection of lowered “interest” in real estate, but rather a top-driven policy correction that has adjusted affordability across the board. Buyers should enjoy the moment and process compared to the past few years of craziness.

What’s Trending?

Over the past couple of weeks for the entire lower Sunshine Coast, we are seeing a noticeable trend to more affordable homes around and under a million dollars. This is likely going to continue to be the trend for the coming months with entry level homes becoming more affordable and improved value at the million dollar mark. Gibsons remains at a much higher price point than Pender Harbour with very different lifestyles associated. Sechelt is somewhere in the middle with values that are still notably lower cost than Gibsons, although both markets are showing increased inventory in the range.

|

Thinking of Selling?

As you may have noticed by the graphs in "What’s Trending", the market prices remain near all-time highs. In the face of the increased interest rates that have occurred and are going to continue, it is probable that values will decrease. Sellers will always be as resilient as the market allows so we have seen a hard drop of 10% and it looks like we might expect a similar drop by this time next year. In other words, it is still a great time to sell and achieve a strong return on your real estate dollar. Sure... expectations have to be lower than the recent frothy 2022 but for anyone that is serious about making a change or liquidating a property, you may not see a better opportunity for a few years.

Getting Ahead of the Curve

When you are pricing your property for sale, experience has shown that you want to price “ahead of the curve”. In most markets, it takes a week or two for a property to gain market awareness. In that two-three week period, the market will not stay still and will either be going up, staying the same, or going down. The market moves forward so if your price is set at “today’s value”, then to be ahead of the curve you would need it to be a balanced market. In a declining market, values will actually be lower in two weeks so to get the best opportunity for a quick sale, you need to price that decline into your thinking. Sure it hurts a little, but it hurts a lot more if you try high and then tip toe down along with the market.

As you may have noticed by the graphs in "What’s Trending", the market prices remain near all-time highs. In the face of the increased interest rates that have occurred and are going to continue, it is probable that values will decrease. Sellers will always be as resilient as the market allows so we have seen a hard drop of 10% and it looks like we might expect a similar drop by this time next year. In other words, it is still a great time to sell and achieve a strong return on your real estate dollar. Sure... expectations have to be lower than the recent frothy 2022 but for anyone that is serious about making a change or liquidating a property, you may not see a better opportunity for a few years.

Getting Ahead of the Curve

When you are pricing your property for sale, experience has shown that you want to price “ahead of the curve”. In most markets, it takes a week or two for a property to gain market awareness. In that two-three week period, the market will not stay still and will either be going up, staying the same, or going down. The market moves forward so if your price is set at “today’s value”, then to be ahead of the curve you would need it to be a balanced market. In a declining market, values will actually be lower in two weeks so to get the best opportunity for a quick sale, you need to price that decline into your thinking. Sure it hurts a little, but it hurts a lot more if you try high and then tip toe down along with the market.

In the past we have seen sellers parallel the market decline to the point where they leave a ton of equity in the rear view mirror. And just like pricing ahead of a downward curve, if the market is surging then pricing where you expect might be in 2-3 weeks is reasonable enough with a lower price evoking competing interest. So remember, price ahead of the curve to ensure top return on your investment.

Thinking of Buying?

Most buyers should be relieved to find the market settling down, even if the cost of borrowing has increased. Given the shock to the real estate market of the interest rate hikes, we continue to experience slow downs across the board and with price reductions.

Most buyers should be relieved to find the market settling down, even if the cost of borrowing has increased. Given the shock to the real estate market of the interest rate hikes, we continue to experience slow downs across the board and with price reductions.

While it may seem unwise to jump too soon into a declining market there are two things that are certain. The first is that you never know where the bottom is until the prices start to rise and they tend to do so quickly. The second is that in a balanced or even a buyer’s market, the buyer doesn’t have to deal with competing bids that can take the values of a home well beyond reason or reach.

Buyers should expect a reasonable period to be able to make decisions and even plan their affairs with some dignity. That is well worth a few points of market volatility and so as most real estate purchases are intended for long term use or investment, buying on a dip is prudent and a more comfortable experience. How long and how low that dip goes is anyone’s guess but enjoying the security of real estate always has its benefits and it is a good time to take the long view.

Mortgage rates will have to sharpen as banks encourage difficult refinancing periods. The BoC predicts almost 50% of variable rate mortgages are at or near their trigger point, the level that borrowers need to dig deeper into their own pockets which is inevitably going to cause some pain. It might be an idea to hedge with a short term fixed against further increasing rates but it is doubtful that the rates will get much higher or even stay elevated for a long period. Best bet is to have a sit down conversation with one of the many great mortgage brokers on the coast to discuss how the market has evolved and what is now affordable.